Spinoffs from Ekofisk II

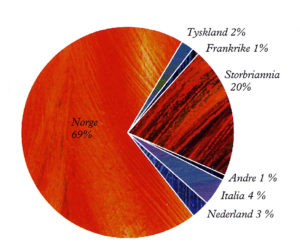

Tildelte kontrakter og innkjøpsordrer for Ekofisk II fordelt på land.

Tildelte kontrakter og innkjøpsordrer for Ekofisk II fordelt på land.During its construction, the Ekofisk II project provided some 15 000 work-years in Norwegian employment among suppliers and sub-contractors as well as at the operator.[REMOVE]Fotnote: Asplan Viak study, 1998

Norway’s share of the total contracts and purchase orders awarded came to 69 per cent – corresponding to NOK 10.3 billion of NOK 14.8 billion.

Overall, the bill for Ekofisk II came to about NOK 17 million, but the Asplan Viak study which provided the above figures was conducted before the whole project had been completed.

It excluded, for examples, costs associated with drilling wells and activities involved in shutting down older Ekofisk platforms.

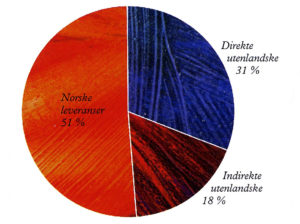

Norsk verdiskapning for Ekofisk II

Norsk verdiskapning for Ekofisk IIBritain’s Amec Process and Energy won the largest contract placed abroad. Worth NOK 1.3 billion, this covered the module support frame and process module for 2/4 J. The UK also accounted for the biggest foreign share of the project, at 20 per cent.

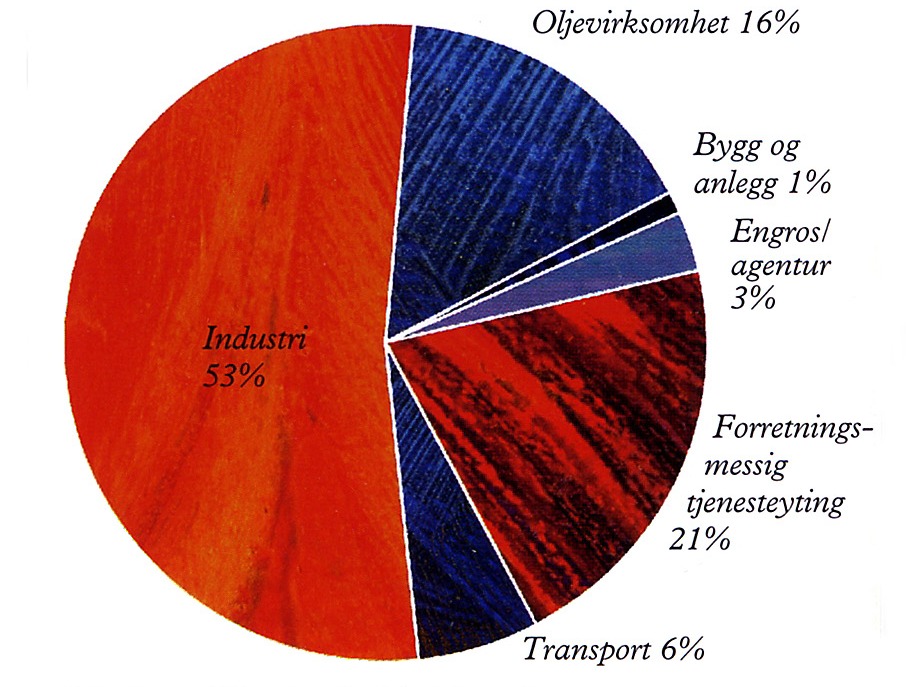

Engineering services, mechanical engineering and oil operations were the areas where Norwegian suppliers secured their largest percentage shares.

HMV in Haugesund, for example, fabricated most of the topsides for 2/4 X as well as the mud module for that platform, while its drilling module came from the USA and Canada.

The Norwegian share of this value creation is calculated by taking account of purchases by domestic contractors of goods and services from foreign suppliers. That in turn provides the basis for calculating the employment effect for Norwegian industry.

Within Norway’s 69 per cent share, such acquisitions by domestic contractors accounted for 18 per cent of the project. That means direct Norwegian value creation was 51 per cent of the total bill, or roughly NOK 7.5 billion.

Norsk verdiskapning fordelt på næring

Norsk verdiskapning fordelt på næringThe country’s smallest share was in transport (lifting) and wholesale/agency deliveries. There were few or no Norwegian suppliers the first category, while domestic companies in the second group delivered foreign-made products.

Source: Phillipsmagasinet 2/98: 13.

Ekofisk II newsletter, 1998 No. 3